Fake BlackRock Bitcoin ETF Report Triggers $65M BTC Liquidation

Misinformation strikes again in crypto as false reports of an approved Bitcoin ETF by BlackRock led to over $65 million in liquidations on exchanges within minutes.

The debunked information first circulated on social media, claiming the SEC had greenlit a spot Bitcoin ETF product by BlackRock. The fake post sparked enough attention to push Bitcoin from $27,900 to almost $30,000.

Also read: BlackRock: Spot Bitcoin ETF Application Still Under Review by SEC

But prices quickly retreated to $28,000 as it became clear the report was bogus, leading leveraged traders who bought the peak to get liquidated when unable to meet margin requirements.

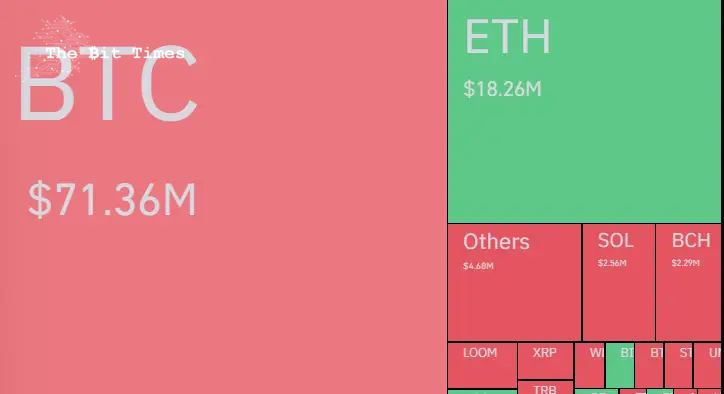

Cascade of Bitcoin liquidation crosses $71 million

According to data from Coinglass, the cascade of liquidations totaled $71.36 million as the brief crypto rally rapidly reversed course. The overall liquidation at press time ever since the fake news dropped stood at $114.7 million.

Lookonchain data showed that the FOMO caused many users to lose money. A whale bought 20.5 WBTC using 613,201 USDC. However, they would sell it for a loss of $49k in just 10 minutes.

This painful lesson highlights the risks inherent in reacting hastily to unverified information in a volatile crypto market. While potential SEC approval of a Bitcoin ETF generates great excitement, traders must exercise caution when momentum spikes on flimsy evidence.

Comments

Post a Comment