ChatGPT picks 3 cryptocurrencies to use as cash vs. CBDCs

Kristalina Georgieva, Managing Director of the International Monetary Fund (IMF), spoke at the Singapore FinTech Festival 2023 on November 15. In her speech, Georgieva stated that Central Bank Digital Currencies (CBDCs) have the potential to replace cash in our society.

“CBDCs can replace cash, which is costly to distribute in island economies. They can offer resilience in more advanced economies. And they can improve financial inclusion where few hold bank accounts.”

— Kristalina Georgieva

However, some individuals view the idea of using a CBDC with skepticism due to its highly controlled and centralized nature.

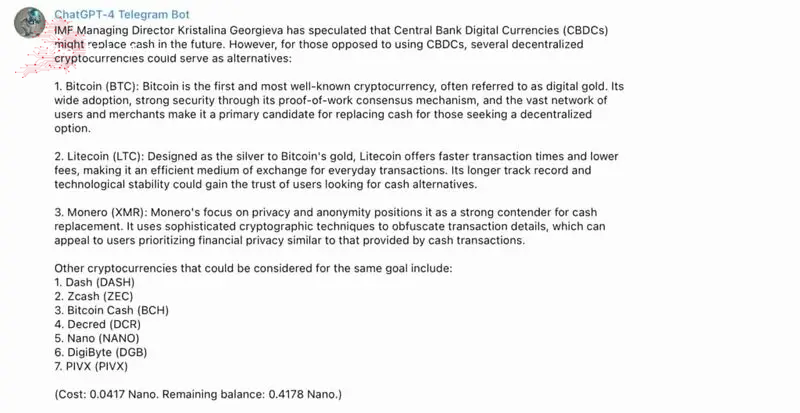

In this context, Finbold asked ChatGPT-4 to mention 10 decentralized cryptocurrencies to use as cash as an alternative to the rise of central banks’ digital currencies. In the prompt, we also asked GPT-4 to pick 3 out of the 10 and justify its pick in a brief paragraph.

AI’s 10 cryptocurrencies to use as cash instead of CBDCs

Interestingly, the API used for this research is a Telegram bot that allows direct payments for each ChatGPT prompt. This ‘pay-per-use’ tool accepts multiple cryptocurrencies as cash and uses one of its picks, Nano (XNO), as the unit of accounting.

Answering the prompt, the Artificial Intelligence (AI) provided the following output and list:

“IMF Managing Director Kristalina Georgieva has speculated that Central Bank Digital Currencies (CBDCs) might replace cash in the future. However, for those opposed to using CBDCs, several decentralized cryptocurrencies could serve as alternatives.”

- Bitcoin (BTC)

- Litecoin (LTC)

- Monero (XMR)

- Dash (DASH)

- ZCash (ZCH)

- Bitcoin Cash (BCH)

- Decred (DCR)

- Nano (XNO)

- DigiByte (DGB)

- PIVX (PIVX)

Bitcoin (BTC)

“Bitcoin is the first and most well-known cryptocurrency, often referred to as digital gold. Its wide adoption, strong security through its proof-of-work consensus mechanism, and the vast network of users and merchants make it a primary candidate for replacing cash for those seeking a decentralized option.”

— ChatGPT-4

Litecoin (LTC)

“Designed as the silver to Bitcoin’s gold, Litecoin offers faster transaction times and lower fees, making it an efficient medium of exchange for everyday transactions. Its longer track record and technological stability could gain the trust of users looking for cash alternatives.”

— ChatGPT-4

Monero (XMR)

“Monero’s focus on privacy and anonymity positions it as a strong contender for cash replacement. It uses sophisticated cryptographic techniques to obfuscate transaction details, which can appeal to users prioritizing financial privacy similar to that provided by cash transactions.”

— ChatGPT-4

Nevertheless, it is notable that the adoption of CBDC is growing worldwide. As of June 2023, 11 countries have already adopted the centralized solution for digital money. The IMF said that 100 countries are exploring their own solutions.

Interestingly, decentralized cryptocurrencies are facing a harsh regulatory environment, which difficulties their growth as competitive tools for cash worldwide.

Comments

Post a Comment