Terra Classic soars 50% in a day; Is $0.10 next for LUNC?

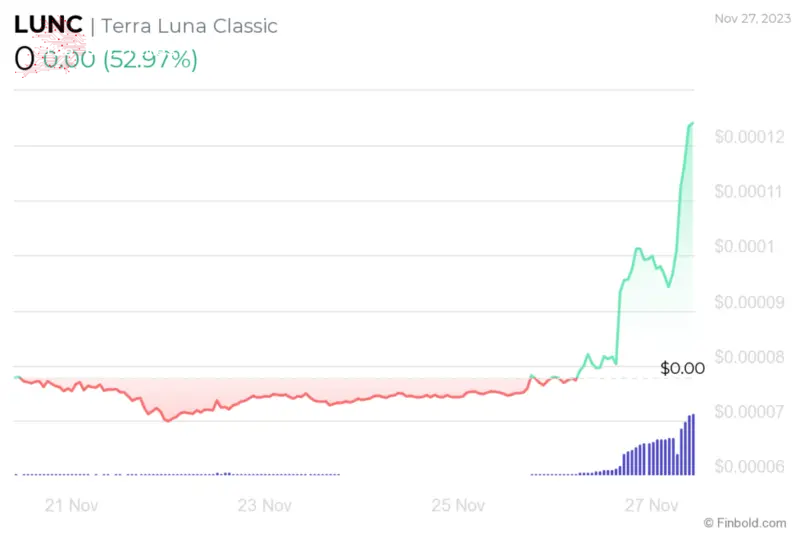

Terra Classic (LUNC) has witnessed an impressive surge of 97.22% over the last 30 days, a significant increase from its October 27 price of $0.0000646, which has prompted investors to set their sights on the $0.10 mark.

In the most recent 24-hour period, LUNC, the native token of the troubled Terraform Labs, experienced a substantial 54.23% spike in value. This surge comes amid the recent news of the possible extradition of the former CEO of Terraform Labs, Do Kwon, from Montenegro to either South Korea or the USA.

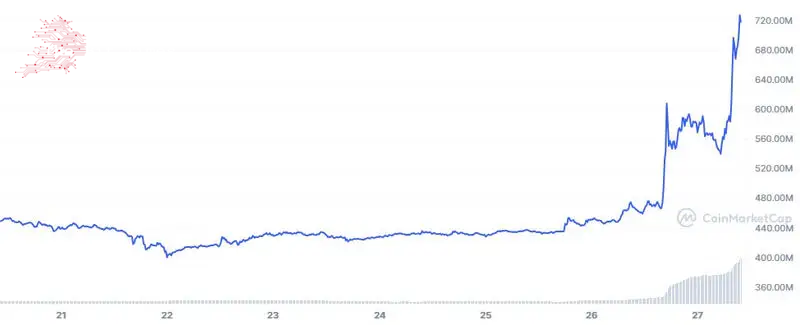

Along with its price gains, Terra Classic’s market cap experienced a significant increase, which at press time stood at $718 million, which is an increase of $270 million or 54.57% from the $448 million it stood at seven days ago, according to the latest information obtained by Finbold from the cryptocurrency monitoring platform CoinMarketCap on November 27.

Recent developments surrounding Terra Classic

Previously this year, the US Securities and Exchange Commission (SEC) accused Terraform Labs and Kwon of orchestrating a multi-billion dollar crypto fraud, explicitly involving a Terra algorithmic stablecoin and other securities. News of possible extradition and resolution of these charges is immediately reflected upon the price of LUNC.

Coupled with the recent announcement of Binance Futures listing TerraClassicUSD (USTC) perpetual contracts, featuring up to 50x leverage. Terra Classic’s value has gained an even more optimistic outlook with this news.

Additionally, the Terra Luna Classic v2.3.0 upgrade proposal has gained community approval via governance voting. The on-chain deployment of terrad client v2.3.0, known as “v6,” includes a dynamic validator commission module.

Terra Classic price analysis

Meanwhile, at the time of press, Terra Classic was trading at $0.0001227, reflecting a 52.97% increase in the last 24 hours. Along with this improvement, it surged by 59.24% over the past seven days and an over 90% advance on its monthly chart.

At the moment, LUNC is currently experiencing 15 green days out of a possible 30 in the previous period, which, coupled with a negative yearly inflation rate of -3.18%, presents solid fundamentals.

However, it is essential to note that it is currently trading below its 200-day moving average, which indicates the previous movements of a singular asset and can give a general direction of its possible direction.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Comments

Post a Comment