Top Crypto Gainers Today Apr 26 – Helium, Wormhole, Theta Fuel, Synthetix

Exciting news has rocked the global crypto market. A one-of-a-kind satoshi, the smallest unit of Bitcoin, recently sold for a remarkable 33.3 Bitcoin, equivalent to an astonishing $2.13 million, in an auction on CoinEx Global. Mined during Bitcoin’s fourth halving by viaBTC, this “epic sat” received 34 bids, with the winning bid doubling the runner-up’s offer of 20 Bitcoin. More than just a transaction, this sale marks a significant moment for the crypto community, underscoring widespread acceptance and appreciation for Bitcoin.

Biggest Crypto Gainers Today – Top List

Are you excited to explore today’s top crypto gainers? Let’s preview our top picks before diving in. Helium leads decentralized IoT connectivity with 500,000+ LongFi Hotspots globally, offering affordable, scalable wireless infrastructure. Transitioning to Wormhole, it emerges as a leading interoperability protocol, facilitating seamless data and token transfer across multiple blockchains.

Now, onto Theta Fuel; it powers transactions within the Theta blockchain, particularly in video streaming, elevating user engagement and rewards. Then, Synthetix functions as a decentralized exchange for synthetic assets, ensuring precise asset tracking and seamless trading via its protocol. With data as our guide, let’s glean actionable insights into their market performance and investment outlook.

1. Helium (HNT)

Helium is a decentralized blockchain network launched in July 2019 for Internet of Things (IoT) devices. Its mainnet enables low-powered wireless devices to communicate and send data through nodes known as Hotspots. These hotspots, which combine a wireless gateway and blockchain mining device, allow users to mine and earn rewards in HNT.

Operated by individuals, Hotspots form a public wireless network for IoT devices, focusing on decentralization and scalability. With over 500,000 Helium LongFi Hotspots globally, the network is accessible and cost-effective.

Helium Hotspots generate HNT tokens, rewarding owners for network maintenance and expansion. Additionally, HNT holders can stake tokens to run validator nodes, contributing to network security and governance.

📱Important Update: Helium Wallet App v2.7.5 (Android & iOS)

The v2.7.5 release addresses a bug where Hotspot reward claims for individual Hotspots were non-functional while claim all functionality was still operational. This issue is now fixed.

Please see v2.7.0 for details on… pic.twitter.com/xa56A7r9dN

— Helium🎈 (@helium) April 20, 2024

Helium has also introduced 5G-powered Hotspots for faster speeds and lower latency. Despite its technical advancements, Helium sets itself apart by offering a practical solution without extravagant promises.

Currently, HNT is priced at $4.15, marking a 17.05% increase in the last 24 hours. Its market dominance is 0.03%, with a 124% increase over the past year. Helium is trading 83.47% above the 200-day SMA, indicating potential overbuying. While its 30-day volatility is 17%, liquidity remains high with a volume-to-market cap ratio of 0.0407.

2. Wormhole (W)

Wormhole is an interoperability protocol facilitating secure data and token transfer across leading blockchains. Its architecture empowers developers to create multichain applications. It leverages liquidity and user engagement across over 30 blockchain ecosystems. Moreover, its applications span DeFi, NFTs, and governance, supporting various blockchain interactions.

Wormhole’s W token facilitates cross-chain transfers, ensuring seamless asset exchange. With Wormhole Connect, developers can build exchanges accessing liquidity from multiple chains. Additionally, Wormhole facilitates cross-chain governance and gaming applications.

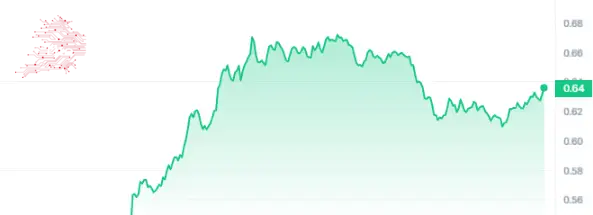

W is making waves with its current price of $0.637014, surging by 16.90% in the last 24 hours. Despite a market dominance of 0.05%, it boasts high liquidity, with a volume-to-market cap ratio of 0.6896. With a market cap of $1.14B and a 24-hour volume of $784.33M, Wormhole proves its significance. Over the past 7 days, it outperformed the global crypto market with a 12.00% increase, though slightly behind similar Ethereum Ecosystem cryptocurrencies at 12.70%.

Wormhole's W token is now natively multichain using the Wormhole Native Token Transfers (NTT) framework 💥

Native W is now available in SPL format on @Solana and ERC20 format on @Ethereum, @arbitrum, @Optimism, and @buildonbase. pic.twitter.com/pwaJohYGXT

— Wormhole (@wormhole) April 25, 2024

Furthermore, Wormhole’s recent launch on major blockchains like Solana, Ethereum, Arbitrum, Optimism, and Base marks a significant milestone. This expansion allows the W token to operate as an SPL token on Solana with EVM compatibility and as an ERC20 token on EVM-compatible chains. This dual functionality streamlines token movement between networks, eliminating the need for liquidity pools. It signifies the completion of the second phase of Wormhole’s W token launch roadmap.

3. Mega Dice (DICE)

Mega Dice token, a recent addition from Mega Dice Casino, has already exceeded $500K in its presale. The new DICE token is part of Mega Dice’s broader gamification layer, rewarding existing casino users and attracting new ones.

Mega Dice aims to be the sole crypto casino providing daily rewards linked to platform success. With over 50K users, 10K active players, and $50 million in monthly wagers, its innovative gamification approach presents an enticing opportunity.

$DICE has a hard supply cap of 420 million tokens, with 35% allocated to the presale, selling at a fixed price of $0.069 per coin. After the first $1 million is raised, the presale proceeds to subsequent stages, incrementally increasing the cost.

Investors can buy $DICE at the cheapest price during the presale before listing on exchanges, potentially appreciating. Moreover, holders can stake $DICE for passive income, with 10% of the supply reserved for staking rewards.

$DICE has raised over $500,000 in presale so far! 🔥

Thank you to each and every one of you for being part of our journey! 🙏❤️

Next up, $1 million! 🚀 pic.twitter.com/N94CDeHBOh

— Mega Dice Casino (@megadice) April 25, 2024

DICE entices holders with exciting perks and exclusive benefits. A $2.25 million airdrop is spread across three seasons, each offering $750,000. To participate in the first season, players must wager $5000 or more by May 3, with a maximum airdrop win of $37,500 per entrant.

Early bird bonuses, limited edition NFTs, and a referral program offering a 10% cut of initial investments from referred gamers are also in the pipeline. Holders can also enjoy in-game advantages, adding to DICE’s appeal.

Visit Mega Dice Presale

4. Theta Fuel (TFUEL)

Theta Fuel powers transactions and operations within the Theta blockchain, predominantly in video streaming. It facilitates payments, interactions with smart contracts, and rewards for streamers and viewers. TFUEL is integral to the Theta.tv live streaming platform, driving its functionality since its inception in 2017 by gaming enthusiasts Jieyi Long and Mitch Liu. Unlike THETA, which serves as a governance token, TFUEL is the primary token for network transactions and rewards.

TFUEL’s significance lies in its multifaceted utility. It enables viewers to support their favorite streamers by donating tokens and rewards content creators for their contributions. Additionally, TFUEL incentivizes engagement by allowing viewers to earn tokens through activities such as watching ads or interacting with content. Moreover, individuals who operate caching nodes play a crucial role in enhancing the platform’s performance and are rewarded with TFUEL for their efforts.

Announcing Theta Hackathon 2024, sponsored by @SamsungNext! It Features 4 tracks (GenAI, EdgeCloud, Video, Gaming) and $250k+ in prizes, & will be judged by reps from Samsung Next, @googlecloud, and Theta Labs. Submissions begin May 8th – learn more here! https://t.co/bP1FQwaojf pic.twitter.com/homb2aH9yS

— Theta Network (@Theta_Network) April 24, 2024

This noteworthy gainer’s current price is $0.125363, reflecting a 7.32% increase in the last 24 hours. Over the past year, it has surged by 152%, trading 204.26% above the 200-day SMA of $0.041365. With a 14-day RSI at 56.41, TFUEL is currently neutral. Of the last 30 days, 16 have been positive, indicating moderate volatility with a 30-day fluctuation of 12%. TFUEL maintains high liquidity with a volume-to-market cap ratio of 0.0459, boasting a market cap of $821.41M and a 24-hour volume of $37.69M.

5. Synthetix (SNX)

Synthetix operates as a decentralized exchange (DEX) platform for synthetic assets. It exposes users to underlying assets via synths without direct ownership. Also, by leveraging oracles, Synthetix ensures accurate asset tracking, enabling users to trade synths effortlessly and eliminating liquidity concerns.

SNX tokens are collateral for minting synthetic assets locked in smart contracts upon issuance. This gainer facilitates seamless trading and staking through its exchange and staking pool, enabling SNX holders to earn transaction fees.

Synthetix facilitates a variety of financial instruments through its support of protocols like Kwenta, Lyra, Polynomial, 1inch, and Curve. It operates on Optimism and Ethereum mainnets, collateralized by SNX, ETH, and LUSD to issue synthetic assets.

Since transitioning to Optimistic Ethereum, it has reduced gas fees and Oracle latency, enhancing platform efficiency and accessibility. This shift aligns with Synthetix’s mission to provide seamless, cost-effective trading experiences, preserving its decentralized integrity.

If you're holding non-USD spot synths on Ethereum Mainnet (L1), swap these to sUSD (or other assets) using @1inch or @DefiLlama ASAP.

The Spartan Council will utilize a discount rate on Monday for the synth redeemer. The longer you wait to redeem your non-USD synths, the more… pic.twitter.com/GSn2WP6RsQ

— Synthetix ⚔️ (@synthetix_io) April 24, 2024

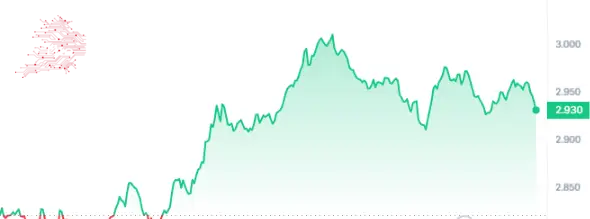

SNX is priced at $2.94, experiencing a 3.97% surge in the last 24 hours. Over the past year, it has increased by 20%. Trading at -12.75% below the 200-day SMA of $3.37, Synthetix shows signs of neutrality with a 14-day RSI of 42.82. Out of the last 30 days, 12 have been positive, with a 30-day volatility of 19%. SNX maintains high liquidity with a volume-to-market cap ratio of 0.1744, boasting a market cap of $337.30M and a 24-hour volume of $58.81M.preale coins

Read More

- Biggest Crypto Gainers

Comments

Post a Comment