Why Bitcoin could skyrocket to $1 million thanks to this overlooked factor

Although Bitcoin (BTC) has started to consolidate its gains from the previous days, setting the mood for the majority of other assets in the cryptocurrency market, a stellar price of a whopping $1 million is almost a certainty in its future with one particular factor at play.

As it happens, the Bitcoin market seems to be in the early stages of a phenomenon called ‘game theory,’ which could play an important part in driving further mainstream adoption and price gains for the flagship decentralized finance (DeFi) asset, according to The Motley Fool’s RJ Fulton.

How will Bitcoin reach $1 million?

Specifically, the United States Securities and Exchange Commission (SEC) approving spot Bitcoin exchange-traded funds (ETFs) has opened the way for a broader adoption of the maiden crypto asset, allowing institutional investors to gain exposure while avoiding direct involvement with the crypto sector.

Picks for you

Indeed, hedge funds, retirement plans, and other institutions that invest money on behalf of their clients and which previously could not or would not enter the crypto market because of its complexities can now include BTC in their portfolios and, in return, flood the Bitcoin market with considerable institutional capital.

According to The Motley Fool data, about 700 professional investment firms, including the likes of Millennium Management, Morgan Stanley (NYSE: MS), and Bracebridge Capital, own around $5 billion worth of spot Bitcoin ETFs, demonstrating the perceived importance of including Bitcoin in their portfolios.

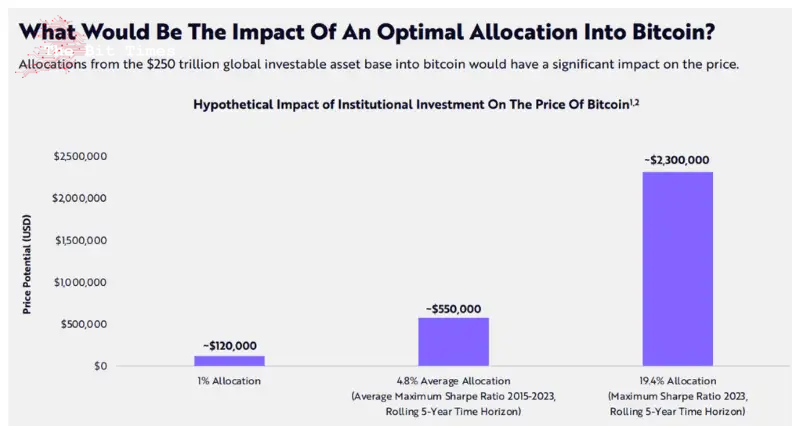

If recent studies are anything to go by, the ideal exposure is about 5%, and with institutional investors managing nearly $130 trillion in assets, Bitcoin’s market capitalization could get above $7 trillion (from the current $1.35 trillion), while the price of the digital asset could exceed $400,000.

On the other hand, a recent study by ARK Invest has suggested that a 5% allocation might be overly conservative, arguing instead that the ideal exposure level should be near 19%, in which case the market cap of Bitcoin could climb to $25 trillion and its price to a whopping $1.3 million.

Game theory for Bitcoin

This is an example of game theory in its infancy – institutional investors (rational actors) making strategic moves in their own best interest based on observing the actions of others. In this case, institutions see their peers profiting from their BTC investments, creating fear of missing out on the returns.

In accordance with their natural competitiveness, these institutional players might use the massive resources in their hands to try and stay ahead of the competition, creating more sense of urgency and taking the game to a whole new level, sending the price of Bitcoin to new records.

As a reminder, game theory is a concept that deals with competitive interactions and strategies in which the outcome of a participant’s choice of action depends critically on the actions of other ‘players,’ often applied in the contexts of business, finance, biology, politics, and other areas.

Bitcoin price analysis

For now, Bitcoin is trading at the price of $68,260, down 0.5% in the last 24 hours, with an accumulated loss of 4.32% in the previous seven days but nonetheless gaining 7.35% over the past month, according to the latest charts retrieved by Finbold on May 28.

All things considered, the price of Bitcoin might be heading toward the mind-blowing figure of $1 million sometime in the future, but it is important to understand that trends in this market can sometimes change tremendously, so doing one’s own research is critical.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Comments

Post a Comment