Bitcoin registers an all-time low transaction volume, spot trading fades away

Since February 2024, Bitcoin (BTC) has traded in a price range between $60,000 and $72,000, with two deviations. This has carved a mostly neutral momentum for the leading cryptocurrency, now seeing its trading and transaction volume fade away.

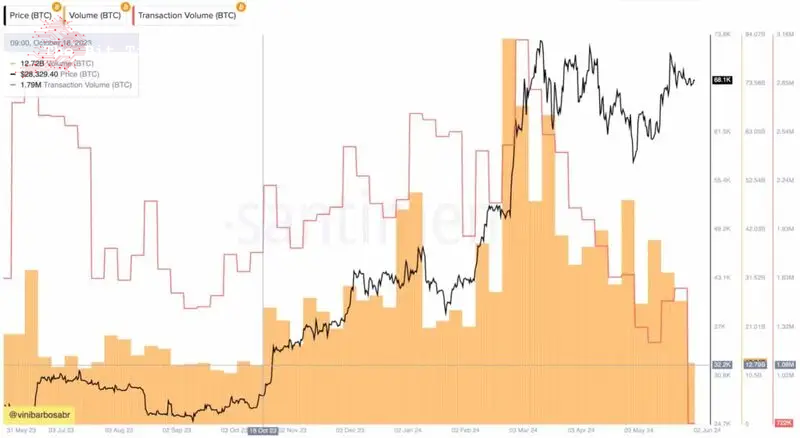

Finbold retrieved data from Santiment on June 2 showing both metrics with the BTC price, currently at $68,100. In particular, the seven-day trading volume plummeted below $14 billion to the same level as 2023, when Bitcoin traded below $30,000.

Moreover, the chart evidences a lack of interest in Bitcoin trading and on-chain transaction volumes, with the second remarkably low. As observed, the network registered only 722,000 BTC moved in seven days. This contrasts with the 1.79 million BTC in October 2023, with a similar trading volume and half the price.

Picks for you

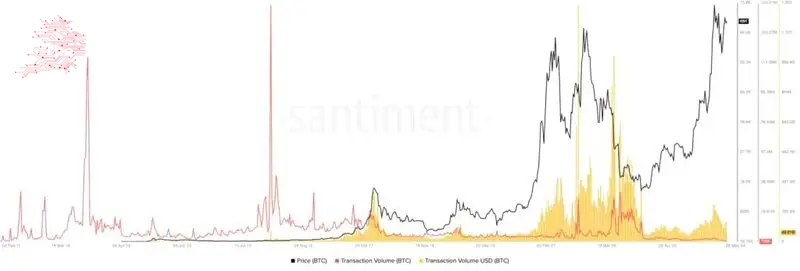

If we zoom out of the chart, Bitcoin’s current on-chain transaction volume shows its lowest value since the beginning. This highlights a remarkably low network activity, which has not followed the increased demand for speculative BTC over the years.

Bitcoin ETFs and derivatives volume

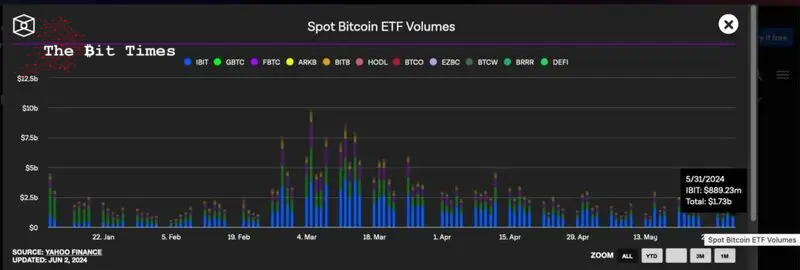

Meanwhile, this year’s approved Bitcoin spot ETFs have made $1.73 billion, according to data retrieved from IntoTheBlock and Yahoo. Overall, these ETFs‘ last seven trading days totaled $12 billion in volume, similar to BTC’s spot volume on crypto exchanges.

This suggests an increased interest in trading the regulated and custodial exchange-traded funds instead of Bitcoin itself.

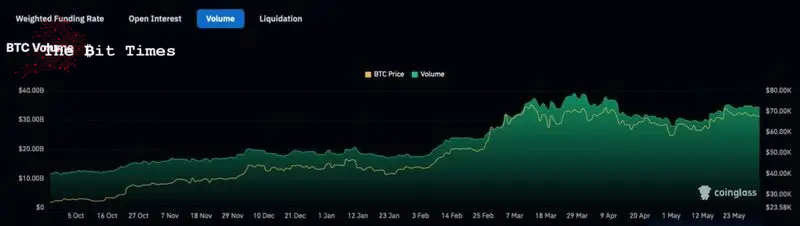

The derivatives volume also highlights the increased interest in purely speculative demand for the leading cryptocurrency. Data from CoinGlass shows a daily volume superior to $34 billion—nearly three times the seven-day volume for spot trading.

Notably, the exchanged volume of futures contracts and other Bitcoin derivatives financial products has remained stable after peaking in March 2024.

In conclusion, these indicators suggest a higher market interest in BTC price speculation through Bitcoin ETFs and derivatives. This is opposed to acquiring Bitcoin for self-custody or long-term hold from cryptocurrency exchanges or using the permissionless blockchain for real peer-to-peer transactions.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Comments

Post a Comment